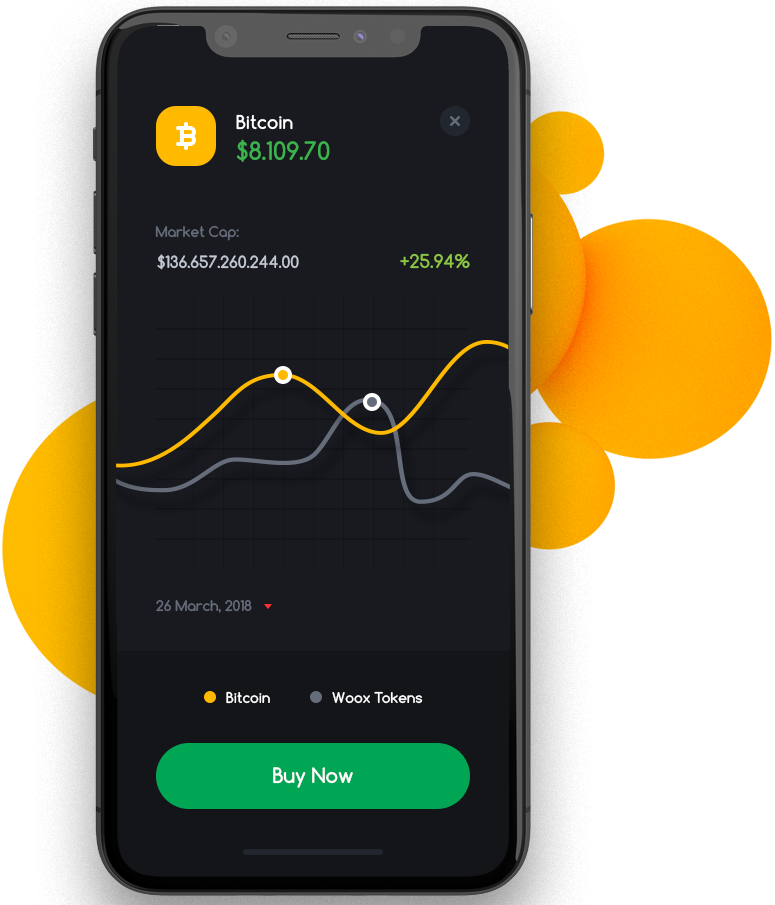

The most trusted cryptocurrency platform

Industry best practices

Bitvest supports a variety of the most popular digital currencies.

Secure storage

We store the vast majority of the digital assets in secure offline storage.

Account privacy

We will never share your private data without your permission

Focused, Active Management of High-Growth Digital Assets.

BTCMine Global Ltd is a registered investment platform providing digital asset investment management services to individuals. We provide a dynamic investment solution to clients in need of a self-operating portfolio, as well as a smart fund with flexible time and investment amount. In the rapidly evolving landscape of digital assets, the concept of focused, active management has emerged as a key strategy for maximizing returns and minimizing risks. High-growth digital assets, such as cryptocurrencies, blockchain-based tokens, and other decentralized assets, have shown immense potential for generating substantial profits. However, their inherent volatility and complexity demand a thoughtful and dynamic approach to investment.

Starter pack

-

Duration:

For 1month(s)

-

Referral:

2%

-

Hashrate:

5Ph/s

Premium pack

-

Duration:

For 2month(s)

-

Referral:

2%

-

Hashrate:

10Ph/s

Gold pack

-

Duration:

For 3month(s)

-

Referral:

10%

-

Hashrate:

15Ph/s

Build your savings without even trying.

Turn on Round-up Rules and start saving up effortlessly. Whenever you make a purchase, Goals make it easy to save for the things you want or want to do. There’s no need for spreadsheets or extra apps to budget and track your money.

-

BTCMine Global Ltd is a registered investment platform providing digital asset investment management services to individuals. We provide a dynamic investment solution to clients in need of a self-operating portfolio, as well as a smart fund with flexible time and investment amount. In the rapidly evolving landscape of digital assets, the concept of focused, active management has emerged as a key strategy for maximizing returns and minimizing risks. High-growth digital assets, such as cryptocurrencies, blockchain-based tokens, and other decentralized assets, have shown immense potential for generating substantial profits. However, their inherent volatility and complexity demand a thoughtful and dynamic approach to investment.

-

Digital assets are a class of assets considered dangerous and inconvenient. Many reasons such as liquidity, money laundering accusation, uncertainty of regulation, access restriction, volatile markets, functionality inquiries reduce trust in these assets. We believe that the risk factor should be eliminated for all people who believe that finance will rise on distributed systems. That's why we offer high interest returns to platform investors. With careful and detailed examination of market conditions, daily trading volume, expectations; we change our portfolio distribution and adjust our investment strategy. With this active fund management, you enjoy the fixed interest rate return on the user side.

-

Successful investment management companies base their business on a core investment philosophy, and Bynamic is no different. Although we offer innovative and specific strategies through digital asset funds, an overarching theme runs through the investment guidance we provide to clients— focus on those things within your control. There are basically four principles that we attach great importance to:

1) Create clear, appropriate investment goals: An appropriate investment goal should be measureable and attainable. Success should not depend on outsize investment returns or impractical saving or spending requirements.

2) Develop a suitable asset allocation using broadly diversified funds: A sound investment strategy starts with an asset allocation befitting the portfolio's objective. The allocation should be built upon reasonable expectations for risk and returns and use diversified investments to avoid exposure to unnecessary risks.

3) Minimize cost: Markets are unpredictable. Costs are forever. The lower your costs, the greater your share of an investment's return. And research suggests that lower-cost investments have tended to outperform higher-cost alternatives. To hold onto even more of your return, manage for efficiency. You can't control the markets, but you can control the bite of costs and efficiency.

4) Maintain perspective and long-term discipline: Investing can provoke strong emotions. In the face of market turmoil, some investors may find themselves making impulsive decisions or, conversely, becoming paralyzed, unable to implement an investment strategy or rebalance a portfolio as needed. Discipline and perspective can help them remain committed to a long-term investment program through periods of market uncertainty. -

Digital assets refer to any form of electronically stored value or ownership that exists solely in a digital or electronic format. These assets are represented by unique identifiers on a distributed ledger or blockchain, providing a secure and transparent way to track ownership, transactions, and authenticity. Digital assets can include various types of tokens, cryptocurrencies, digital securities, virtual goods in video games, digital art, domain names, and more.

The most well-known type of digital asset is cryptocurrency, such as Bitcoin, Ethereum, and thousands of other tokens built on blockchain technology. However, the concept of digital assets extends beyond just cryptocurrencies and covers a wide range of valuable assets in the digital realm.

-

We are here to help you with any problems and questions you may encounter while using the platform and during your investment experience. You can always contact or turn the situation into an opportunity